As the “One Big Beautiful Bill Act” works its way between the House and Senate, the reconciliation bill, and its extensions of the expiring 2017 Tax Cuts and Jobs Act, move one step closer to becoming law.

The bill’s “beauty” is now under examination in the Senate and the process has lawmakers, insiders, media, and leaders of family-ownedbusinesses wondering what stays and what gets goes.

One goal of the bill is to make the tax bill’s provisions permanent, according to Senate Finance Chair Mike Crapo (R-ID), in discussing the bill’s movement into the Senate.

Under the proposed bill, the estate tax exemption would rise to $15 million for individuals (from $13 million) and $30 million for married couples next year, and it would rise with inflation afterward.

The bill would also increase the pass-through business tax deduction from 20% to 23% and it expand the definition of who can qualify. The deduction would be available to owners of sole proprietorships, LLCs and partnerships, and other pass-through entities. Since 80% of family businesses are pass-through entities, this is good news.

But, as it stands, the bill clarifies that pass-through entities are considered a specified service trade or business under section 199A (i.e., businesses in the fields of health, law, accounting, consulting, etc.). As a result, they are denied deductions for state and local income taxes incurred at the entity level and would be required to separately state these payments, essentially eliminating the benefit of these state workarounds for these businesses.

The House version also offers an increase to $40,000 for the SALT (State and Local Taxes) cap starting in 2025, with a phasedown for taxpayers making more than $500,000 a year. The income and deduction caps would increase by 1% each year through 2033 before staying the same thereafter.

The bill would also suspend the requirement under Section 174 to capitalize and amortize domestic research and experimental expenditures for amounts paid or incurred in tax years 2025 through 2029, allowing for full deductibility of such domestic outlays.

The Insiders’ View

What this all means for family-owned businesses requires some nuanced thinking, and it’s likely lawmakers will need to contort themselves to make it all add up.

According to two Capitol Hill insiders and top tax experts, like Russ Sullivan of Brownstein and Michael Hawthorne of Squire Patton Boggs — both law and government affairs firms — it’s clear things can change quickly on Capitol Hill.

In a recent roundtable discussion, I had the opportunity to discuss the bill’s status with both and asked them whether they think family businesses should be optimistic.

According to Hawthorne, “President Trump is actively engaged in the process and will keep working out disagreements.” “I’m optimistic that by the end of the summer there should be approval,” he said.

But things are different in the Senate, Sullivan warned.

“They [the Senate] need 60% acceptance unless it’s a reconciliation bill, which needs 51%,” he says. “The House planned the bill around reconciliation.”

Sullivan knows some senators believe the House bill cuts too deeply into Medicaid but, he says, “other Senators think there should be more spending cuts.”

To make matters more complicated, the House will have to vote again on the Senate version of the bill. But there is optimism for family businesses, according to both experts. As it stands, the bill offers a tax cut for every tax bracket, except those making over earning more than $1 million annually.

“Family businesses should be optimistic as this bill extends and makes permanent the 2017 Tax Bill and Jobs Act, lowers taxes, improves the estate tax and restores research and development deductions,” says Sullivan. Hawthorne agrees and adds: “Congress is very aware of the need to make things more permanent and certain.”

Winners and Losers

For those in the manufacturing industry, the proposed House bill brings back favorable tax rules, including bonus depreciation for the cost of production upgrades and a temporary research and development tax break. On the losing end, low-income earners will seecuts to Medicaid coverage and SNAP food vouchers. The bill also requires able-bodied recipients up to 64 years old to find work of some kind, and beneficiaries would have to pick up more costs, as would the states.

Private foundations also face an escalating tax based on their size: 2.78% for private foundations with assets between $50 million and $250 million, 5% for entities with assets between $250 million and $5 billion; and 10% for foundations with assets of at least $5 billion, such as the Gates Foundation, a longtime target for Republicans. The bill also raises taxes to 5% on immigrants transferring money (remittances) to foreign countries and restricts health coverage tax credits.

If the tax bill doesn’t provide enough Capitol Hill drama, the Department of Treasury has let Congress know the so-called “X-Date” — the date the U.S. is expected to run out of money — will hit sometime in August.

Congressional Republicans are seeking to raise the debt ceiling to about $41 trillion as part of the tax and spending cut package or do away with the debt limit altogether. It should be noted that Treasury Secretary Scott Bessent is asking lawmakers to increase or suspend the debt limit by before the August recess.

Are Tariffs Helping or Hurting?

In a recent “spot poll” by Family Enterprise USA, family-owned business leaders weighed in on the Trump Administration’s fluctuating tariff plan. When we asked some 60 family-owned business leaders if “They are affected by tariffs?” Fifty-four percent of family-owned business leaders said they were affected. On the other hand, 46% said they were not.

When asked the follow up question: “Are you concerned about tariffs affecting business?” the results were more dramatic. More than 64% said they were concerned, while 36% said they were not.

The resolution of the tax bill, “X” date, and effect of the tariffs on business is a fast-moving and ever-changing story, but it’s important to stay engaged with your Congressional lawmakers and to make your voice heard on these important issues.

Pat Soldano, President of Family Enterprise USA, and the Policy Taxation Group, both are non-partisan organizations advocating for family enterprises of all sizes. Both groups are organizers of the Congressional Family Business Caucus and of the Family Enterprise USA Annual Family Business Survey.

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including Leading Forward, Succeeding in Succession, and Navigating Governance that help to advance family business in our community.

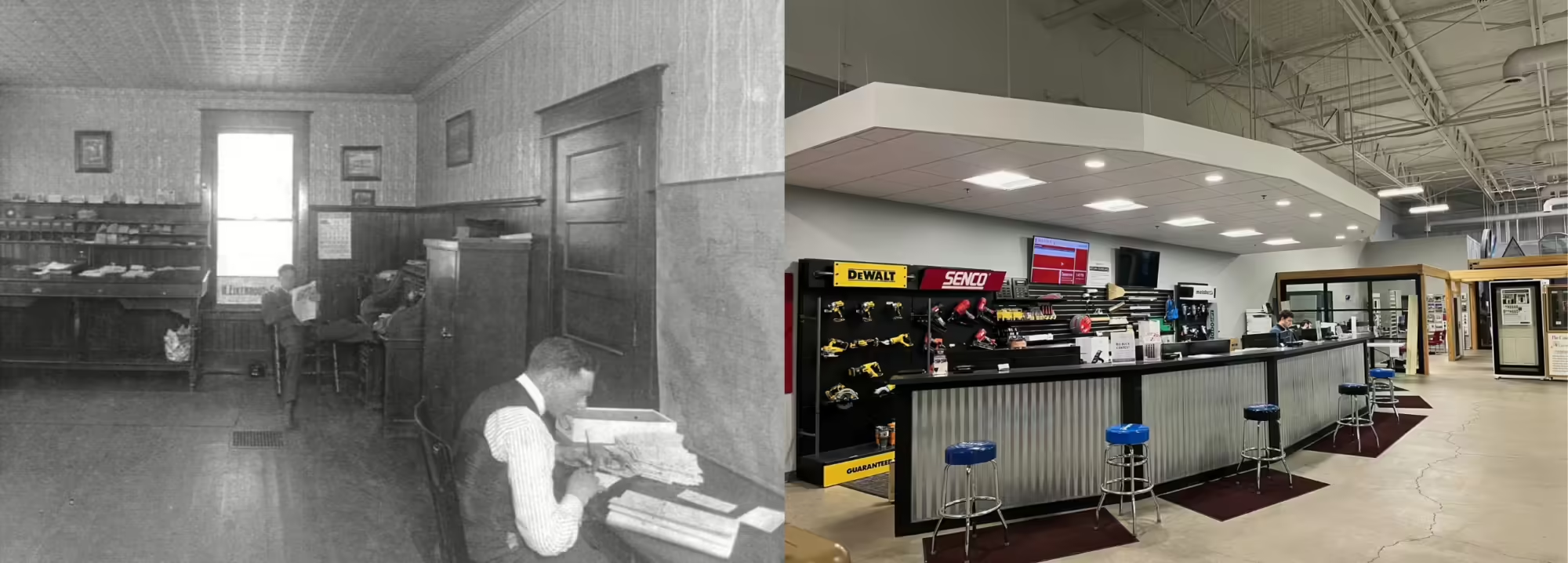

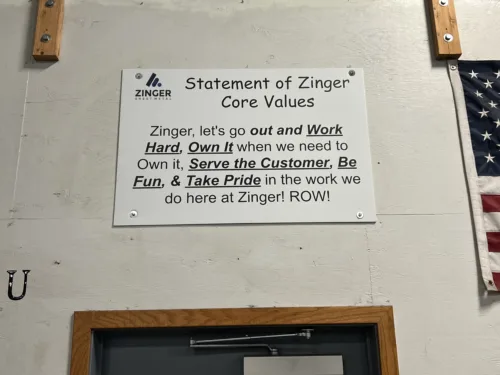

What leadership lessons have you learned from the previous generation that you rely on today?

What leadership lessons have you learned from the previous generation that you rely on today?

What leadership lessons have you learned from the previous generation that you rely on today?

What leadership lessons have you learned from the previous generation that you rely on today?

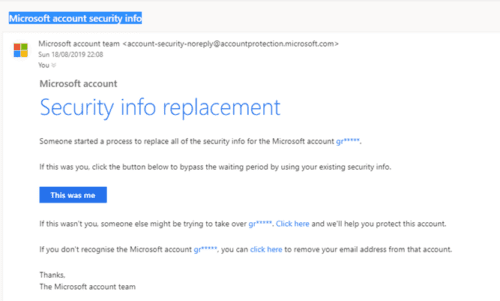

How to Manage the Risk of Cyber Attacks

How to Manage the Risk of Cyber Attacks

We had the pleasure of speaking with Ben Kuncaitis from

We had the pleasure of speaking with Ben Kuncaitis from