In celebration of their 70th family business anniversary, we sat down with Family Business Alliance member, Zinger Sheet Metal. Read on to learn about the owner and leader, David Capestany, third-generation steward of the West Michigan family business.

About Zinger Sheet Metal

Zinger Sheet Metal was founded in 1954 by Hank and Harold Zinger. The innovative brothers saw a gap in the market for prefabricated ducts. Under their leadership, Zinger Sheet Metal installed and manufactured duct work, primarily in the residential space. Today, the company serves the commercial construction industry and HVAC distributors through duct work manufacturing and HVAC CAD detailing.

The Pathway Into the Family Business

“When Hank and Harold owned the company, we were a small, mom and pop shop,” David shared. His grandfather had four daughters, and the only family member who ended up in the business was Nelson Capestany, Hank’s son-in-law and David’s father who joined the business in the 1980s.

Nelson Capestany had high hopes for the future of the family business. As a Cuban immigrant, David explained, he felt pulled to carry the legacy forward. “My dad was determined in pushing me in the direction of working for the family business. For someone who had to start from nothing in the US, his vision for me was to either be a doctor or take over the company. Those were my options in his eyes.”

David began helping in the business at 12 years old. He worked two days a week in the summers sweeping the floors, doing maintenance, and other projects. “If you mow fast, you get to sit in the shade for half an hour. If you’re slow, you get the full heat of the sun,” David recalls his dad telling him, and it’s clear this sentiment sums up the work ethic and mindset of the Zinger family.

Capestany continued working in the business on and off throughout high school and college. After graduating from Grand Valley State University with a degree in Management and Finance, he took some time out of the business to venture on his own. “A year later, I was engaged and looking for my next step, and Zinger was the best opportunity at that time, so I went in full time,” David said.

From there, he never looked back. Having started on the shop floor, David eventually began working as an estimator, then accounting and finance, gradually taking on more responsibilities. He explains, “At that time, we were 10-12 employees, and we’re about 24 now. Eventually, I started taking on more of a leadership role.” In 2014, David succeeded the business from his father.

Developing Your Passion

More than twenty years into his family business journey, David reflected on how his passion has grown. “Growing up, I wasn’t passionate about duct work. But the opportunity to be able to learn something in depth and get to the point where you have some expertise and people call you for help is rewarding. A lot of kids want to be passionate about whatever it is that they’re doing right out of school, but I realized when you take years and work at something, the passion grows.”

While it may have taken time to develop passion for duct work, David’s passion for the business and the people it supports has been a constant. The desire to continue improving employees’ livelihoods drives his desire to grow.

Over the years the company’s growth has enabled them to provide more significant benefits and meaningful career pathways. The third-generation leader explained they recently started working with a life coach who comes in every week to spend time with employees. They also began completely covering health insurance for their employees. “Those are some of the things I am most proud of – the opportunities we have been able to provide for employees.”

70 Years of Growth and Change

One of the most pivotal changes for the company’s trajectory was in the mid-2000s when Zinger Sheet Metal shifted from mainly residential work to commercial. Along with that, they expanded their repertoire of product offerings, enabling them to provide complete duct systems. “It opened up a completely different world for the business with new opportunities,” says Capestany.

Nearly twenty years later, the business is continuing to tailor its vision for the path forward. Capestany shared his goal to grow the company in its service footprint as well as product offerings. “About two years ago we took on a few larger customers out of Ohio, so now we’ve started to expand our footprint to become more regional.”

As for expanding their products and services, David hopes to become “more of a one-stop shop” for customers. They are continuing to hone their use of technology with the goal of passing on efficiency to their contractors and customers. For example, using CAD modeling, they have been able to tailor the installation process. “That’s what we’ve been really focused on – helping contractors reduce their installation time by providing them a detailed plan which helps reduce the amount of skilled labor that they need.”

A New Approach to Leadership

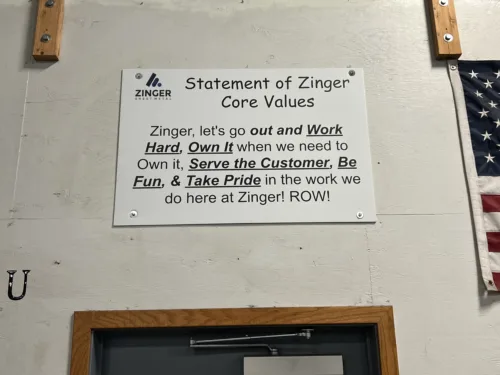

One element he contributes to some of Zinger Sheet Metal’s success is the implementation of EOS over the past few years. It has been a pivotal change for the business, David shared. “We began focusing on our leadership team and being intentional about our vision. We began sharing the purpose and vision with employees and setting goals.”

Working toward building a leadership is something David expressed he wished he had done sooner. “When you’re in your twenties, you think you know everything and can do everything, so you do it. So, I think investing in people earlier, giving them the opportunity to grow, and not forcing myself to be the expert in everything,” Capestany said.

The Vision Ahead

As for the family vision, David hopes that his kids take an interest in the business. “I’m trying to give them an opportunity to learn the business a little bit but also want to give them the opportunity to explore what they want.”

His 14-year-old son works at Zinger in the Summers. His three children also get to have a hands-on experience through schoolwork. “Having a sheet metal shop is fun because for school projects or visits, we might come here or build something. Other kids will bring cardboard, and my kids will bring metal. That was always me growing up, too. My projects were always metal because that’s what I knew how to work with.”

This feature is part of our Member Anniversary Program. For more information or if you are interested in exploring opportunities to be featured, please email aislinn@fbagr.org.

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including Leading Forward, Succeeding in Succession, and Navigating Governance that help to advance family business in our community.

What leadership lessons have you learned from the previous generation that you rely on today?

What leadership lessons have you learned from the previous generation that you rely on today?

What leadership lessons have you learned from the previous generation that you rely on today?

What leadership lessons have you learned from the previous generation that you rely on today?

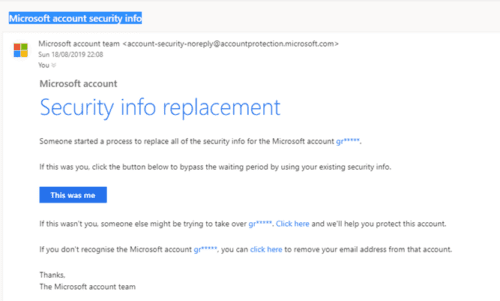

How to Manage the Risk of Cyber Attacks

How to Manage the Risk of Cyber Attacks

It’s officially Tech Week in Grand Rapids! The non-conference conference is designed to showcase the region’s vibrant tech community, and we’re excited to share insights from a few of our family business members in this fast-paced industry.

It’s officially Tech Week in Grand Rapids! The non-conference conference is designed to showcase the region’s vibrant tech community, and we’re excited to share insights from a few of our family business members in this fast-paced industry.

Business Group. Maintaining the same name, values, and customer service, WM Uniform is carrying the family’s legacy and team forward through the partnership.

Business Group. Maintaining the same name, values, and customer service, WM Uniform is carrying the family’s legacy and team forward through the partnership.

family business’s most important contribution?

family business’s most important contribution?

in the last 10-20 years.” When Allison was a teenager, they began offering wedding services again and Ludema’s continues to expand and connect within the West Michigan Community.

in the last 10-20 years.” When Allison was a teenager, they began offering wedding services again and Ludema’s continues to expand and connect within the West Michigan Community.

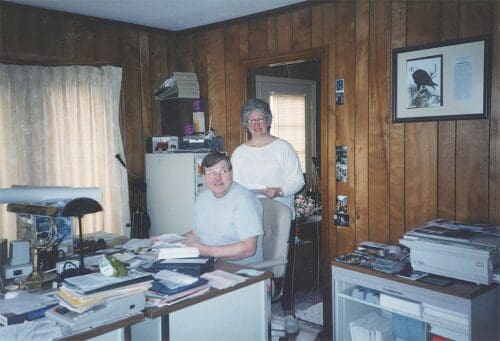

Before joining, Alan worked for a few notable local, family-owned corporations, including Steelcase and Bissel as a financial analyst. “I knew it was time for a new opportunity.” It was at that time that George approached him with a job offer. “We’ve been talking, and we might have a job for you at GL Resources.”

Before joining, Alan worked for a few notable local, family-owned corporations, including Steelcase and Bissel as a financial analyst. “I knew it was time for a new opportunity.” It was at that time that George approached him with a job offer. “We’ve been talking, and we might have a job for you at GL Resources.” “Alan has really opened our eyes to be more forward thinking,” shares Joanie. Navigating generational differences when working together is inevitable in family run organizations, but the Snyder family has thoroughly enjoyed working together.

“Alan has really opened our eyes to be more forward thinking,” shares Joanie. Navigating generational differences when working together is inevitable in family run organizations, but the Snyder family has thoroughly enjoyed working together.